(#11) Many Cases: Adjudicators (SST-EI Statistics) :: Justice 4 EI Misconduct

(Problem #4: Error #11) Many Cases: SST TMs 'Reverse-Engineer' Decisions

(#11) Many Cases: SST TMs ‘Reverse-Engineer’ Decisions (Justice 4 EI Misconduct)

Disclaimer: This site contains the Personal Opinions of Canadian Citizens. All Claims are being Tested in Court. Until then, everything is for Entertainment Purposes only.

Legal Principles: Error #11 (EI Adjudicators ‘Selectively Apply’ Law)

Fundamental Questions (8): #3-#10

Grounds of Review (4): FCA §18.1(4)(a-c,f)

Vavilov Principles (5+): Decision & Outcome

Fairness Principle & Meaningful Reasons

(b) Other Statutory or Common Law (¶111-14)

(d) Evidence Before Decision Maker (¶125-26)

(e) Submissions of the Parties (¶127-28)

(f) Past Practices & Past Decisions (¶129-32)

(g) Impact of Decision on Individual (¶133-35)

Questions & Issues

Jurisdiction: Are there Objective Standards for ‘vires’ (Jurisdiction & Admissibility)?

Fairness & Consistency: Are these standards Discretionary [and Public]? On what Grounds? What Reasons are Required? Is Consistency Required? Can EI ADMs Arbitrarily Include/Exclude Evidence between different-yet-similar Cases?

Private Law: Can ADMs Ignore Employment Contracts? On what Grounds? Are they Binding? Are Contracts Admissible by Both Parties or Just the Employer? Is there Equal Application (or Implication) Requirements? Must they be Stated in their Reasons?

Common Law: Are various legal ‘Tests’ Applicable to EI, specifically ‘KVP’? When? What are the Grounds for Using/Omitting such Tests? Can they be Argued by Claimants? Can they be unilaterally Introduced by Adjudicators while Refused to Claimants?

Jurisdiction: Conflicting Standards or Definitions re. Admissibility.

Fairness: SST TMs Arbitrarily Use (or Exclude) ‘Inconvenient’ Evidence & Legal Tests. This is facilitated by using pre-written ‘Atrium Decision Templates’.

Errors in Law: Employment Contracts & Common Law Tests (such as ‘KVP’) are often Misused or Selectively Applied to Reverse-Engineer Desired Outcomes.

Process Errors: The EI Home Statute is being Violated in Decision Making.

Law & Jurisprudence

Please consider my SST-AD Written Arguments (@[P16] ‘DA-694-Args’) incorporated (by reference) into this J.R. Factum (Memorandum of Fact & Law). To save space, I won’t reprint everything it contains, but large sections are critically relevant.

This specific section incorporates the ‘#1: Nullified Policy & Misused CBA’ & ‘#4: Management Inconsistency’ sections. 1

Procedural Fairness & Errors in Law: There are three specific legal principles that were often applied selectively, depending on the desired Outcome: ① ‘Just Cause’ Analysis, ② the Use & Analysis of Employment Contracts (CBAs), and ③ the Common Law ‘KVP Test’. EI ADMs consistently choose the application that led to Denial of EI Benefits, even when that meant contradicting prior findings or selection of these exact same entities in their own previous C19-MM Decisions.

Just Cause Analysis: Prior to the Pandemic, it was understood that conducting ‘Just Cause’ Analysis (per: EI Act §29[c]) was the primary basis for determining whether to Disentitle or Disqualify EI Claimants.

This included: EIA §29(c)(xi): ‘Employer Practices Contrary to Law’ Analysis and EIA §29(c)(vii/ix): ‘Significant Changes’ to the Employment Contract.

Mysteriously, the Home Statute’s primary test for determining Disentitlement was deemed ultra vires – precisely when thousands of Claimants applied for EI Benefits claiming these exact reasons…

Employment Contracts: ‘Selective Unfairness’ was applied to Employment Contracts (and Collective Agreements) too. When citing relevant contractual Terms ‘justified’ Dismissing Cases, most SST Members did. However, when applying relevant Terms would result in Allowing EI Benefits, it was suddenly ultra vires to do so. My Case received this unfair treatment – among hundreds of other Cases…

Common Law ‘KVP Test’: During the pandemic, I noted many SST Decisions (at both GD & AD levels) unilaterally cited the ‘KVP Test’ 2 to justify Denying EI Benefits Claims. But, whenever applying KVP would result in the Claim being Allowed, it was instead declared ultra vires using pre-written Decision Templates.

This [mis]use was consistent: whatever Jurisdiction was needed to Deny Benefits was ‘found’ by TMs – regardless of their own previous Cases. This is unfair and unreasonable. (per: Vavilov ¶121) ADMs cannot “Reverse-Engineer desired Outcomes” by using ‘selective application’ of the Law.

This miscarriage of Justice regularly occurred in ‘C19-MM’ (Pandemic-Mandate-Misconduct-related) Cases (post-2021). Querying & Analysing the SST Decisions Database for Cases prior to 2020, evidences the fact that this inconsistency was rare.

In most cases, SST Members did not ‘selectively’ refuse to apply relevant legal principles and statutory provisions on Jurisdictional grounds prior to 2020.

This section relies on – and incorporates by reference – Arguments from several other sections in this Factum. They are introduced & primarily contained there to facilitate logical flow, but Analysed ‘in practice’ to demonstrate their erroneous use here.

Error #1: ‘Rizzo Analysis’: ‘Employment Insurance Act’ (‘Just Cause’ Analysis)

Error #3: Rule of Law & Jurisdiction (Employer Practices ‘Contrary to Law’)

Error #4: Private Law (Employment Contracts) & Common Law (‘KVP Test’)

Errors #14-15: ‘Atrium Decision Templates’ ‘Reverse-Engineer’ Decisions

Cross-Case Statistical Analysis

Below are various Statistical Analyses of pandemic-era SST Decisions. 3

SST Cases: Statistical Analyses (Inconsistent Application of Law)

* Incomplete Listing: Only Includes Final-Disposition Decisions *

* Current to: 2024-11-30 * (All Stats Queried from SST Decisions Database)

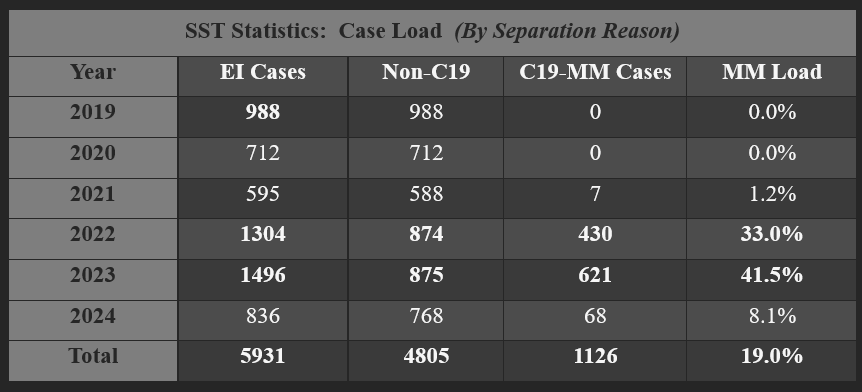

C19 Mandate ‘Case Load’: Total Cases by Cause (SST)

This table analyses the ‘C19-MM’ Case Load by Cause: Cross-Comparison of [‘Vaccine Mandate’] ‘Misconduct’-related Cases at the Tribunal [SST-EI] from 2019–2024.

2019 is included to provide a pre-COVID benchmark for cross-comparison purposes.

** Source Data: https://Justice4EIMisconduct.com/assets/4-Selective-Law/SST-Stats.xlsx **

During the Pandemic (2020-2024), there were 4943 Total SST-EI Cases Adjudicated:

(2019) ‘Pre-Pandemic Baseline’: = 988 Cases | (2019: Total SST-EI Benefits Cases)

(2020-21) ‘Pre-Mandate Lull’: 653.5 Cases = (712 + 595) / 2 | (2020-21 Average)

(2022-23) ‘Mandate Peak’ Cases: 1400 Cases = (1304 + 1496) / 2 | (2022-23 Average)

(2020-2024) Total Cases: [‘C19-MM’] 1126 vs. 3817 [Non-Mandate] ([All] 4805 - 988 [2019])

Pre-Pandemic: 988 Cases | Pre-Mandate: 654 Cases | Mandate Peak: 1400 Cases

In late-2021, ‘Mandatory Vaccination Policies’ (‘MVPs’) began to be enforced across the country, which caused a significant spike in EI Claims, most of which hit the Tribunal between 2022-23. (i.e. During the ‘Peak Pandemic’ Period)

Contrary to popular belief, this was not a ‘fringe minority’ (“with unacceptable views”).

Throughout the entire Pandemic (2020-24), 22.3% of All SST-EI Appeals were caused by ‘non-compliance’ with MVPs. ([C19-MM] 1126 / 4943 [Total] 5931 - 988 [2019])

(2020-24) Pandemic Total: [‘C19-MM’] 1126 vs. 3817 [‘Normal’] = 22.28% of All SST Cases.

During the ‘Mandate-Peak’ (2022-23), 37.5% of All EI Appeals were caused by ‘non-compliance’ with MVPs. ([C19-MM = 430 + 621] 1051 / 2800 [1304 + 1496 = Total])

(2021-22) ‘Mandate-Peak’: [‘C19-MM’] 1051 vs. 1749 [‘Normal’] = 37.54% of All Cases.

Pre-Mandate Pandemic Decline: 653.5 / 988 = 66% | Pre-Mean: 653.5 = (712 + 595) / 2

During the first two years of the Pandemic (pre-Mandates), there was a 34% Decline in SST-EI Cases, partly due to the reduction in EI Claims covered by the CERB Program. ([2020-21: Average] 653.5 / 988 [2019: Baseline])

Later, C19 MVPs caused a 42% Increase in Case Load (vs. pre-Pandemic benchmark: 1400 / 988), and a 2.14x Increase over the ‘Pre-Mandate Lull’ (1400 / 653.5).

Mandate Case Load Increase: 1400 / 988 = 142% | Peak-Mean: 1400 = (1304 + 1496) / 2

Pandemic Case Load Increase: 1400 / 653.5 = 214% (Peak-Mean vs. Mandate Lull)

No matter how this is framed, this is a National Crisis. There has never been a singular cause underlying 22% of all SST-EI Appeals (C19-MM Cases / Pandemic Total) – much less a 42% Increase in Appeals provoked by one policy change. (C19-MM ‘Peak’ vs. Baseline)

Worse: MVPs caused a 214% Increase in SST-EI Appeals vs. the ‘Lull’ when we ‘Locked-Down’ most of the Western world. (2022-23 vs. 2020-21: Total SST Cases)

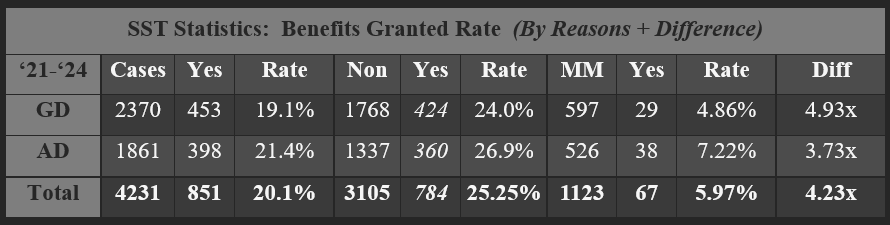

C19 Mandate ‘Decisions’: Final Disposition by Cause (SST)

This table analyses the C19-MM ‘Success Rate’ by Cause: Cross-Comparison of EI Benefits ‘Success’ (Appeals Granted) by Cause.

Benefits Granted Rate: C19-MM (‘Vaccine Mandates’) vs. Non-C19-MM Cases

All of the C19-MM Cases were Appealed through the SST-EI between Jan 2022 (01-04) 4 ,5 & Sept 2024 (09/05). 6 ,7 Analysing their Decisions – compared with non-mandate related EI Cases – exposes serious inconsistency in Reasoning. (Often from the exact same TMs.)

(There were other pandemic-prevention-mandate-related cases in 2021: Masking, etc.) 8

Between 2021-2024 there were 4231 SST Decisions rendered: 9 (GD: 2370 + AD: 1861)

Of these, 3105 were not Mandate related + 1123 were based on policy ‘compliance’. 10

C19-MM: GD: 4.86% (29 / 597) || AD: 7.22% (38 / 526) || Total: 5.97% (67 / 1123)

Non-MM: GD: 24% (424 / 1768) || AD: 26.9% (360 / 1337) || Total: 25.25% (784 / 3105)

This may not seem significant up-front, but a detailed Analysis of their Reasoning proves that there are serious problems with this major discrepancy in Dispositions:

‘Normal’ Cases: 25.25% of the non-Mandate EI Claims were ‘Allowed’ by the SST.

C19-MM Cases: 5.97% of the ‘Vaccine-Mandate’ EI Claims were ‘Allowed’ by the SST.

This means C19-MM Cases were Denied 4.23x more than ‘standard’ EI Claims.

Difference (SST Total): ( [784 / 3105] = 25.25% / 5.97% [67 / 1123] ) = 4.23x

Difference (by Level): GD: 4.93x (24% / 4.86%) || AD: 3.73x (26.9% / 7.22%)

During the ‘Pandemic Peak’ more than 1 in 3 EI Claims were based on C19 Mandates.

At the same time, these Cases were Denied 423% more often than ‘Normal’ EI Claims.

Next, we will analyse the Reasons given to see whether TMs were Fair & Reasonable.

Argumentation

The following Cross-Case Analyses cover just over the last decade (2014-2024). 11

(NB: Although not included in these Analyses – since it was published in 2013 – the first SST Decision is notable as the TM conducted a Rizzo Analysis of the EI Act & Regulations…) 12

‘Just Cause’ Analysis (EI Act §29[c]): The Home Statute EI ADMs are Appointed to Interpret in their Decisions requires them to fact-find for 14 ‘Just Cause’ factors.

Contract Analysis (EIA §51 & DBEP §21): All three Authorities (Statute, Precedent & Policy) also require ADMs to consider Employment Contracts in their Decisions.

‘KVP Test’ (re. LSWU #2537 v. KVP [p.85]): This 65+ year-old Legal Test (for determining the validity of unilaterally-imposed corporate Policies), was made precedent by the Supreme Court in 2013 (‘Irving’: 2013 SCC 34 [¶24-27]).

In C19-MM Cases, KVP was ‘selectively cited’ (‘Reverse-Engineered’) to ensure that SST Decisions always Denied Claimants their EI Benefits – even when that required using legally-contradictory [diametrically-opposed] rationale in their Reasoning.

‘Atrium’ Decision Templates (‘Reverse-Engineering): EI ADMs must address the specific Facts & Legal Pleadings of each Claimant on their own merits – and justify each Finding by their Reasons. They cannot ‘build’ their Decision by ‘choosing’ pre-written Templates from other Cases, to ‘justify’ Outcomes pre-set by the Templates…

Appointment Analysis (SST Members): During the ‘Peak Pandemic’ (2022-23), the SST lost 28% of their TMs, while the Case Load increased by 214% (vs. 2020-21). After this inexplicable loss, they quickly increased their TMs by 50%, while now Denying C19-MM Claimants 4.23x more often than ‘normal’ Pandemic-Claimants. Is there a reasonable answer for how & why this anomaly occurred?

Decision Impact Analysis (Vavilov: ¶133-35): EI ADMs are required to:

① “Explain why [their] Decision best reflects the Legislature’s intention.”

② “Ensure that their [Decisions] are justified in light of the Facts & Law.” [and]

③ “Ensure that their Reasons demonstrate that they considered the consequences of [their] Decision.”

None of these requirements were reflected in their Reasons & Decisions. Instead, TMs inserted Templates from other Cases that ‘guided’ them to pre-set Outcomes.

EI ADMs are truly engaging in legal gymnastics in their attempt to avoid the obvious: the legally requisite process – along with decades of historical precedence – requires detailed Fact-Finding. And the Evidence provided by Claimants is not ultra vires.

Home Statute: ‘Just Cause’ Analysis (EIA §29[c])

For 35+ years, the SST examined both [Provincial] Labour Laws and [Provincial] Health & Safety Laws – despite EI being a federal program. Importantly, the Canada Labour Code (‘CLC’) – a federal statute – is both the governing Labour & H&S Legislation.

[AM: ¶98]: “…The term ‘illegal’ has a broader meaning than merely ‘contrary to the criminal law’ and can include contraventions of employment standards and legislation (CUB 16209), collective agreements (CUB 51219), and licensing board certifications.” (2023 SST 1886: AM v. CEIC)

Given this fact, it is historically & legally unreasonable to refuse to conduct §29(c)(xi) Analysis to fact-find for whether the “Employer acted Contrary to Law.”

Both binding [FC] precedent – and multiple SST TMs concede – that both CBAs and the CLC must be considered under ‘Contrary to Law’ Analysis. (What happened?)

Before the pandemic (2014-19), there were 539 Cases that Contain ‘29(c)’ Analysis: Apparently, it was understood that this statutory requirement mattered (until 2020)…

See: 13 Cases relying on ‘29(c)(xi)’ Analysis: ‘Employer Practices Contrary to Law’

See: 26 Cases relying on ‘29(c)(xi)’ Analysis during the Pandemic. (2020-2024)

How is it reasonable for SST TMs to ‘selectively’ conduct this required investigation?

Even during the pandemic, TMs did conduct this statutorily-mandated Fact-Finding – unless it was related to C19-MM (COVID Vaccination). Then it’s suddenly ultra vires‽

Legal Argumentation underlying these Errors:

Home Statute: Contract Analysis (EIA §51 & DBEP §21)

The same [aforementioned] binding federal precedent (continuously reaffirmed for 3+ decades) requires EI ADMs to examine Contracts as part of this Analysis – and this requirement is also reinforced in EI Statute & Policy:

DBEP §21.2.2: [‘Proving Facts: Gathering All Available Evidence’]: “Evidence is any Information that tends to prove or disprove a point; it can take many forms such as: any written instrument including documents & records such as […] Contracts & Collective Agreements.”

DBEP §21.2.3: [‘Proving Facts: Evaluating the Evidence’]: “In the case of Misconduct or Voluntary Leaving, a Decision cannot be based solely on the Claimant's statement…” The ADM is pointed to EIA §51(b): “If information is provided, take it into account in determining the Claim.” (re. ‘Documents relating to Misconduct Claim’ from the Claimant.)

DBEP §7.2.1.1: [‘Fact-Finding [Misconduct] with the Employer’]: “To determine whether or not a Claimant was Dismissed for reasons of Misconduct, the Employer is asked to provide […] whether such action or omission violated a provision of the Contract of Employment…” (Employers are required to cite Contract violations‽)

EIA §51: [‘Information’]: “If, in considering a Claim for Benefits, the Commission finds an indication from the documents relating to the Claim that the loss of Employment resulted from the Claimant’s Misconduct or that the Claimant Voluntarily Left Employment, the Commission shall:

(a) Give the Claimant and the Employer an opportunity to provide Information as to the Reasons for the loss of Employment; [and]

(b) If the Information is provided, take it into account in determining the Claim.

The EIA §51 provides specific instructions for when EI Adjudicators: “find indications from the documents [] that the loss of Employment resulted from the Claimant’s Misconduct.” They are required to “give the[m] [] an opportunity to provide Information & […] take it into account in determining the Claim.”

And the DBEP §21.2 explicitly states that ‘Fact-Finding’ for ‘Information’ always involves examining “Documents […] such as Contracts & Collective Agreements.”

Lastly, Vavilov’s requirement for ‘Reasonable Decisions’ re. ‘Common Law’ states:

[Vavilov ¶111]: “Where a relationship is governed by Private Law [(i.e. Employment Contracts)], it would be unreasonable for the ADM to ignore that Law in adjudicating the Parties’ Rights...”

In the six years before the pandemic (2014–2019), there were 365 Cases that seem to discuss contents of ‘Employment Contracts’ & ‘Collective Agreements’ – which is what you would expect to find, based on the EI Digest Principles §21.2.2 (‘Gathering All Available Evidence’) which also states that ‘Employment Contracts’ and ‘Collective Agreements’ are among the “evidence necessary to prove the facts of a particular Case.”

(Twice in five paragraphs EI ADMs are told to gather Contracts for evidentiary purposes.)

But now, in C19-MM Cases [only], examining the relevant Employment Contract sections is deemed ultra vires. How is this practice of ‘selective application’ reasonable?

In 15 Cases, SST TMs Dismissed EI Appeals because the Claimants “did not file [their] CBAs” which they “would have examined” for “Contractual violations.” But, somehow, in their absence, TMs were required to find MVPs ‘compliant’ with missing Contracts‽

In 58 Cases, TMs Dismissed EI Appeals on ‘Management Rights’ grounds – authority that directly derives from Employment Contracts. If CBAs are truly ultra vires, the Management Rights clause is not admissible. How is this reasonable?

And what happens in situations where the specific Management Rights clause in use deems the policy in question Nullified – as in my Case? Without that clause, they cannot enforce any policy – but when properly applied, it prevents the specific policy in question.

On what grounds are CBAs ‘necessary evidence’ to properly determine EI Benefits Eligibility – in hundreds of SST Cases – unless it involves unlawful pandemic mandates?

Legal Argumentation underlying these Errors:

Common Law: ‘KVP Test’ (Policy ‘Validity’ Test)

( The Validity & Applicability of the KVP Test is established by SCC Precedent. )

[2023 SST 99: KM v. CEIC [¶29]: “The SCC has endorsed the KVP Test which means it is good law that should be applied.” (Citing: ‘Irving’ [2013 SCC 34])

[Irving: ¶24]: “The scope of Management’s unilateral rule-making authority under a Collective Agreement is persuasively set out in KVP. […] Any Rule or Policy unilaterally imposed by an Employer and not subsequently agreed to by the Union, must be consistent with the Collective Agreement and be Reasonable.”

[¶25]: “The Employer cannot, by exercising its Management functions, issue unreasonable rules and then Discipline Employees for failure to follow them. Such Discipline would simply be without Reasonable cause. To permit such action would be to invite subversion of the reasonable cause clause.” (cit. 1990 ON-CA 6974)

[¶26]: “Subsequent Appellate Decisions have accepted that rules unilaterally made in the exercise of Management discretion under a Collective Agreement must not only be consistent with the Agreement, but must also be Reasonable.” (citing [3] PE, NF & MB Appellate Decisions) || (2013 SCC 34: CEPU #30 v. Irving Pulp & Paper [¶22-27])

(NB: Surely within this context, facially-unlawful Policies, are also deemed unreasonable…)

During the Pandemic, the [Common Law] ‘KVP Test’ was either applied or argued 24 times. In every situation, the ADM made the ‘findings’ necessary to Deny Benefits – either unilaterally citing KVP to ‘justify’ MVPs or deeming it ultra vires to avoid considering whether the specific MVPs in question were ‘Contrary to Law’.

TMs selectively applied the KVP Test in a way that ensured EI Benefits were Denied:

12x it was unilaterally cited by TMs to Justify using new, non-CBA-compliant corporate policies to Disqualify the EI Claimants. But 12x, when Argued by the Claimants (because the Policy in question Failed KVP Test #1: CBA-Compliance), their TMs ruled that KVP was ultra vires & not arguable (notwithstanding it would have Changed the Outcome). In some cases, it was the same TM applying KVP inversely, ensuring the result was still Disentitlement. Is this Justice‽

Using a Case-Management Tool (‘Atrium’) that selectively-inserts various pre-written findings “as a backbone” (with pre-existing footnotes + citations) – that already pre-determines the final Outcome – and merely ‘filling-in the blanks’ around them is obviously ‘reverse-engineering’. Especially when done to purposely avoid statutorily-mandated fact-finding into whether the “Employer Acted Contrary to Law.”

This violates both Vavilov and Procedural Fairness – and is clearly unreasonable…

Legal Argumentation underlying these Errors:

Atrium Decision Templates (‘Reverse-Engineering’)

This widespread procedural unfairness occurs through the use of Decision Templates – a collection of prewritten Reasons, Citations & Footnotes with contradictory Findings.

TMs can select the Template[s] that enable[s] them to automatically Deny Benefits using prewritten reasons – as these mini-templates control their final Decision.

[Vavilov ¶118]: “…Legislative Intent can be understood only by reading the language chosen by the Legislature in light of the Purpose of the provision and the entire relevant Context… [¶121]: The ADM’s Task is to Interpret the contested provision in a manner Consistent with the Text, Context & Purpose, applying its particular Insight into the Statutory Scheme at issue. It cannot […] ‘Reverse-Engineer’ a Desired Outcome.” (2019 SCC 65: Canada [MC&I] v. Vavilov [¶118-21])

If relying on CBA Terms or the KVP Test [et al] would Deny the Claimant’s Benefits, TMs choose Templates supporting that finding – that reference the appropriate Jurisprudence – with empty blanks to supply the relevant Case-specific details.

But, if CBA Terms or the KVP Test would Grant the Claimant’s Benefits, then they are suddenly ultra vires – again with corresponding, contradictory Reasons & Case Law.

Example: Four common templates re. KVP that are used by TMs: two unilaterally invoked by TMs to justify Employers’ Contract Breaches + two rebutting Claimants who argue that their Employer’s MVPs Breached their Contracts – all with corresponding Case Law & Footnotes.

This is “reverse-engineering desired outcomes” which Vavilov deems unreasonable. Some TMs changed a few words to customise the Template, but the interlinked combination of text, citations & footnotes ‘give it away’:

Examples: KVP Used v. KVP Denied, [via] Footnotes. ** (11 different Cases, All Denied…) **

(This is just one set of examples where conflicting Templates ‘reverse-engineered’ Decisions.)

This results in inconsistent reasoning that consistently favours the government. But, the Outcome is consistent – EI Benefits are always Denied – regardless of whether [or not] the Reasons & Citations given conflict with that same TM’s previous Decision[s]…

Legal Argumentation underlying these Errors:

Tribunal: SST Members (Appointment Analysis)

Coincidentally, there was a significant reduction in SST TMs (Governor-General-Appointed Tribunal Members) during the ‘Peak Pandemic’. 13 ,14

At the same time that the Case Load was increasing by 214%, the Tribunal lost 28% of its Members – some of whom still had substantial time left on their Appointments.

This was followed by a rapid 50% increase in Members, while the rate of EI Denials to C19-MM Claimants increased by 423%. (As compared to ‘standard’ EI Claims at that time)

SST TMs: 1909, 2006, 2010, 2102, 2109, 2207, 2303, 2308, 2310, 2312, 2404, 2407, 2412

Is there any correlation between Mandates and this statistically significant Anomaly?

These facts lead to some obvious conclusions that easily explain this progression…

(But these apparently self-evident conclusions violate Natural Justice…) Reasonable Ones?

Vavilov: Impact on Affected Individuals (¶133-35)

One key Vavilov factor underlying reasonable Decisions. It requires considering:

[Vavilov: ¶133]: “Where the impact of a Decision on an individual’s Rights & Interests is severe, the Reasons provided to th[em] must reflect the stakes. The principle of Responsive Justification means that If a Decision has harsh consequences […] the ADM must explain why [their] Decision best reflects the Legislature’s intention. This includes Decisions with consequences that threaten an individual’s Life, Liberty, Dignity, or Livelihood.

[¶135]: ADMs are entrusted with an extraordinary degree of power over the lives of ordinary people, which [calls for] heightened responsibility […] to ensure that their Reasons demonstrate that they have considered the consequences of [their] Decision and that th[ey] are justified in light of the Facts & Law.”

How does this apply to these frequently reverse-engineered Decisions? Unlawful Mandates had life-altering impacts on many Claimants’ livelihoods – during a global crisis – yet none of our Decisions had Reasons that addressed or justified this situation.

And my EI ADMs gave no consideration to this crucial factor in any of my Decisions.

Per Vavilov – and the EI Act (§29[c]) – ADMs are required to do the following three tasks:

① “Explain why [their] Decision best reflects the Legislature’s intention.” (re. ‘Just Cause’)

② “Ensure that their Reasons demonstrate that they considered the consequences of [their] Decision.” (re. Employer Acting Contrary to Law & Significantly Changing the Contract, while unlawfully Locking-Out Workers to “compel compliance with new Terms [& Policies].”)

③ “Ensure that their [Decisions] are justified in light of the Facts & Law.” (Where was this‽)

Instead of wielding their “extraordinary degree of power over the lives of ordinary people” justly – by fulfilling these three requirements when writing their Reasons & Decisions – ADMs “Reverse-Engineered Desired Outcomes” by selecting & inserting pre-written findings from other Cases that consistently guaranteed EI Benefits would be Denied…

(Notwithstanding that these legally-conflicting Atrium Templates contained multiple Errors.)

Application

There are very unequal applications of the Law, depending on the circumstances. Prior to the Pandemic, most EI ADMs followed their Home Statute, conducting Just Cause Analysis (per EIA §29[c]). However, this statutory requirement is universally ignored in C19-MM Cases, with varying excuses offered [or not] in their Decisions. The same applies to their use of Employment Contracts & Common Law Principles.

Jurisdiction: There are no historical authorities listed, leaving each ADM ‘Discretion’ – which is widely abused in COVID-19 Mandate Cases. ‘Jurisdiction’ is whatever choice of template leads to Misconduct Findings, regardless of the consequences – both for the wrongly Denied Claimants – and the EI Program’s Reputation. This cannot stand. For the sake of Justice, Judicial Intervention is needed to permanently fix this unreasonable Decision-Engineering.

Fairness & Consistency: EI Adjudicators need to be reminded to Justify their Decisions – Vavilov requires this to Find their Decisions ‘Reasonable’. It is patently unreasonable for ADMs to selectively either include or exclude Facts, Evidence, Contracts, and Common Law Tests & Principles, without proper Justification. Merely repeating the words ‘Jurisdiction’ should be insufficient for this lack of Fairness to stand upon Review. Furthermore, their Jurisdictional choices & Reasons should be consistent – individual EI ADMs should not be permitted to change these choices (Templates) at-will to ‘justify’ specific Outcomes.

Specific Elements: Here are specific elements drawn from my Case:

(a) Individual Facts & Evidence: Emails, Letters, Policies, etc.

(b) Private Law: CBAs (generally) and specific Terms & Clauses.

(c) Common Law: Binding Precedents, Principles & Legal Tests

On what reasonable Grounds can ADMs selectively apply various legal fundamentals like Contracts, their Terms & Common Law Principles? On what Grounds can they choose differently in other Cases? (Fundamental Justice requires consistent Application of Law & Fact – not consistent Outcomes – regardless of the effects on the Individual. Or any [potential] impacts to the EI & Justice systems – and their Reputations…)

Arbitrary [mis]use of ‘vires’ to exclude key Facts & Evidence raises both Jurisdiction & Fairness considerations, under FCA §18.1(4)(a/b).

Unequal Application of the Law – and of various Legal Principles – is an Error in Law, since something cannot be both Applicable and Inapplicable simultaneously. This meets the Grounds found in FCA §18.1(4)(c).

This is also arguably ‘acting contrary to law’ per FCA §18.1(4)(f).

Decision

For all these Reasons, we respectfully ask this Court to Quash TM Lafontaine’s Decision on the Grounds that it is Unreasonable.

Sources:

Statutes

(‘EIA’) Employment Insurance Act (SC 1996, c.23)

https://laws.justice.gc.ca/eng/acts/E-5.6

EIA §29(c): ‘Just Cause’ Analysis (CanLII)

Jurisprudence

2019 SCC 65: Canada (MC&I) v. Vavilov [¶111] || ( https://CanLII.ca/t/j46kb )

2013 SCC 34: CEPU Canada, Local #30 v. Irving Pulp & Paper, Ltd. (¶22-27)

1965 (ON-LA) 1009: re. LSWU, Local #2537 v. KVP Co. Ltd. (p.85).

SST Decisions Database: https://decisions.sst-tss.gc.ca/sst-tss/en/d/s/index.do

2021 SST 377: JL v. CEIC (¶29-¶34, ¶41-¶42, FN: 5-13)

(GDEI) 2013 SST 1: JB v. CEIC (¶10-13 ¶27ff)

KVP Templates: KVP Used v. KVP Denied, [via] Footnotes

Evidence

(‘Affidavit’) Affidavit of EI Claimant

https://Justice4EIMisconduct.com/assets/FCA-Affidavit.pdf

(‘SST-Stats’) SST Statistics: 2019-2024 (MS Excel)

https://Justice4EIMisconduct.com/assets/4-Selective-Law/SST-Stats.xlsx

(‘DA-694-Args‘) SST-AD Written Arguments: ([P16]: p.244-76 [ADN6-2..34])

‘#1: Nullified Policy & Misused CBA’ ([P16]: p.255-58 [ADN6-13..16])

‘#4: Management Inconsistency’ ([P16]: p.263-66 [ADN6-21..24])

KVP Test: This Common Law Test sets out the six conditions that shall be met before Employers can unilaterally impose a Rule (or Policy) “not subsequently agreed to by the Union.”

For practical applications of how the KVP Test was selectively [mis]used, see details at: ‘Error #4: Common Law’ and ‘Errors #14-15: Atrium Decision Templates’.

1965 (ON-LA) 1009: re. Lumber & Sawmill Workers' Union, Local #2537 v. KVP Co. Ltd. (p.85).

This 1965 Test was formally ratified by the Supreme Court in ‘Irving’ (2013): (¶24-27)

2013 SCC 34: Communications, Energy & PaperWorkers Union of Canada, Local #30 v. Irving Pulp & Paper, Ltd.

All Stats Queried from: SST Decisions Database. (Stats Current to: 2024-11-30)

First [SST-EI] C19-MM Case: KW v. CEIC (2022 SST 217) Decision Date: 2022-01-04

There were seven ‘C19-MM’ Cases in late-2021, but they were not decided on the basis of ‘Misconduct’ for ‘policy violation’. They involved Work Eligibility, Employment Conditions, etc.

Last [SST-EI] C19-MM Case: CEIC v. AD (2024 SST 1065) Decision Date: 2024-09-05

There are C19-MM Cases Decided after this date, but they are all Appellate Remands. (Or were Decided on non-‘Misconduct’ bases: Back-Dating Claims, Work Eligibility, etc.)

This is an interesting Case: 2021 SST 377: JL v. CEIC (¶29-¶34, ¶41-¶42, FN: 5-13).

The Employer’s C19 ‘Masking’ Policy was found to be ‘Contrary to Law’ as it was not enforced consistently.

This proves that TMs will consider EIA §29(c)(xi) when it suits them…

Date range expanded from above to capture all pandemic-mandate Cases, incl. Remands.

Three Cases had non-standard dispositions & could not be bucketed as Finalised Yes/No.

The first full year of SST Cases published in the Decision Database is 2014. The current SST was created by statute in April 2013 – and their first Decision was published on 2013-09-10.

(GDEI) 2013 SST 1: JB v. CEIC. This Case is notable as the TM conducted a Rizzo Analysis!

(‘Appendix A’) Table with SST Membership List links located at: {Appendix ‘A’ (SST Analysis)}

(‘Affidavit’) Information about SST Member Appointments at: [Affidavit: §L]: ¶62 [p.57f]